Save Big with the Amazon Tax Exempt Program for Sellers

Handling taxes is one of the unavoidable parts of running a business, especially if you’re selling through platforms like Amazon. Business taxes require careful record-keeping, including tracking your earnings and expenses. On top of that, tax rules often vary depending on your location thats how to deal with Amazon tax exempt program for sellers.

Now, wouldn’t it be simpler if you didn’t have to pay sales tax in some cases? If you’re a wholesaler, you might be able to skip sales tax altogether. And if you sell wholesale products on Amazon, you could benefit from joining the Amazon Tax Exempt Program (ATEP).

This program makes it easier for wholesalers to purchase and resell goods without the hassle of manually handling tax exemptions.

What Is the Amazon Tax Exempt Program?

The Amazon Tax Exempt Program, or ATEP, allows wholesale businesses to buy products on Amazon Business without paying sales tax. It’s a helpful resource for resellers who often deal with multiple suppliers and platforms where tax exemptions can be a headache to manage.

Keep in mind — sellers who directly sell to the final customer generally won’t qualify for ATEP. It’s important to double-check the sales tax regulations in your local area before moving forward.

Who Can Qualify for ATEP?

If end-consumer sellers don’t qualify for this program, who does? Amazon extends ATEP to specific types of businesses and organizations, such as:

- Resellers: Businesses that purchase products to resell to others.

- Non-profit organizations: Charities and religious groups with tax-exempt status.

- Government agencies: Federal, state, and local authorities.

- Educational institutions: Schools, colleges, and universities.

- Direct payment permit holders: Those with authorization to directly manage their tax payments.

Before you enroll, make sure to check Amazon’s eligibility guidelines for the most current criteria.

Is ATEP Required?

Participating in ATEP isn’t mandatory. But if your business qualifies for tax exemptions, joining the program can lead to significant savings — provided the items you buy are for business purposes and not personal use. If you skip the program, there’s still the option to request a tax refund from Amazon later, which we’ll explain shortly.

Advantages of the Amazon Tax Exempt Program

ATEP comes with several useful benefits for eligible businesses, including:

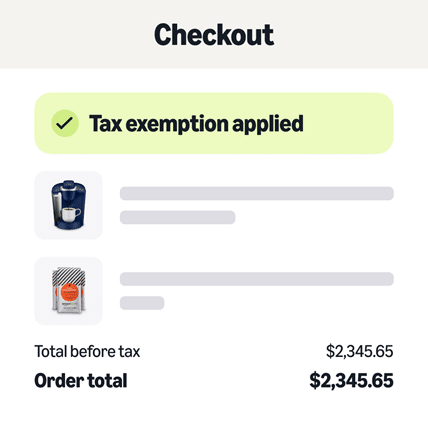

- Tax savings: Certain purchases can be made without paying sales tax, which boosts your profits and frees up more capital to reinvest.

- Simplified compliance: Upload your tax exemption certificate once and Amazon will securely store your documentation, keeping you in good standing with tax authorities.

- Greater convenience: Without ATEP, you’d have to present your tax certificate to every individual seller or retailer.

- Streamlined operations: Wholesalers can easily purchase products on Amazon and resell them, simplifying their overall buying and selling process.

What You Need Before Signing Up for ATEP

Before you enroll in the Amazon Tax Exempt Program, you’ll need to gather some important information. Amazon typically asks for the following:

- The legal name of your business

- The type of organization you operate

- The states where you have a sales tax nexus

- Documentation proving your tax-exempt status

How to Apply for Tax Exemption on Amazon

Think you’re eligible for ATEP? Good news — getting started is fairly simple. Here’s a step-by-step guide:

- Log into your Amazon Seller Central account and navigate to “Business Settings.”

- Under “Taxation Exemption and Licenses,” select “Tax Exemption.”

- Upload your tax exemption certificate.

- Fill in your company details, including business name, type, and operating location.

- Review your application carefully and submit it.

Most applications get processed and approved within 24 hours.

What Happens If You Lose Tax-Exempt Status?

As your business grows and evolves, your tax-exempt status might change too. If you no longer qualify or your exemption expires, you’ll need to start collecting and remitting sales tax again.

To opt out of ATEP, simply go to the Tax Exemption section in your account, click on “Actions,” and choose “Expire” to deactivate your tax-exempt status.

Can You Claim a Refund on Previously Paid Taxes?

If you’ve been paying sales tax on your Amazon business purchases without realizing you qualified for tax exemption, you might still be able to recover those funds.

Once your order is delivered, reach out to Amazon customer support through your Seller Central account. Provide a clear explanation along with your order number, receipt, and tax exemption certificate. To keep things smooth, it’s best to send your documents as PDF files.

Smart Practices for Managing Tax Exemptions on Amazon

Tax compliance should be a priority for any Amazon seller — especially those claiming tax exemptions. Here are some important practices to follow:

- Track your orders carefully: Use Seller Central’s reporting tools to monitor your purchases.

- Keep your tax documentation updated: Stay on top of expiration dates and renew your exemption certificates before they lapse.

- Stay informed about tax laws: Tax regulations can change frequently at both the state and local levels, so it’s important to review them regularly.

- Consider tax management software: These tools can help automate your record-keeping and compliance, saving you time and minimizing errors.

How the Amazon Tax Exempt Program Supports Wholesalers

Wholesalers, resellers, and other qualifying businesses can save time and money by signing up for the Amazon Tax Exempt Program. If you don’t sell directly to consumers and meet the eligibility criteria, head over to Amazon Seller Central and enroll in ATEP.

In addition to leveraging ATEP, wholesalers can optimize other aspects of their operations. SAECOM FBA PRO offers tailored strategies designed to help businesses grow on Amazon — taking your niche, audience, and goals into account to build a roadmap for success.