Amazon Chargeback Guide: Win Disputes Smartly

A chargeback can feel discouraging, especially when your Amazon business is finally taking off. While it may seem stressful at first, it’s important to remember that chargebacks are a common part of eCommerce and can be managed effectively.

Chargebacks occur when a customer disputes a transaction through their bank or credit card provider, usually due to dissatisfaction or a suspected issue with their purchase. Understanding how to handle these disputes professionally helps protect your business and maintain strong seller performance on Amazon.

In this guide, we’ll explain everything you need to know about Amazon chargebacks, including why they happen, how to respond, and ways to prevent them in the future.

What Is an Amazon Chargeback?

A chargeback happens when a customer asks their bank to reverse a payment they made for a transaction. On Amazon, this occurs when a buyer disputes a charge and requests a refund directly from their card issuer rather than contacting you or Amazon first.

Chargebacks can happen for various reasons, including unauthorized transactions, product issues, or delivery failures.

For example, imagine a customer named Sarah notices a $200 charge from Amazon Marketplace she doesn’t recognize. She contacts her credit card company to dispute it. The bank investigates by reaching out to Amazon for transaction details. If Amazon cannot prove the order was valid or delivered, the bank refunds Sarah, completing the chargeback process.

While this protects customers from fraud, it can hurt sellers by affecting their account health and revenue if handled poorly.

Common Reasons Behind Amazon Chargebacks

Chargebacks often stem from customer confusion, dissatisfaction, or payment issues. Some of the most common causes include:

1. Unrecognized Charges

Buyers sometimes dispute payments because they don’t recognize the charge on their statement. Confusing billing names or forgotten purchases can lead to disputes. Ensure your business name appears clearly on customer statements to reduce confusion.

2. Missing Product or Service

Customers may file chargebacks if they claim they never received their order. To avoid this, use reliable shipping methods, track all orders, and resolve delivery issues quickly. For service-based sellers, such as those offering installation or setup, make sure every promised service is delivered as described.

3. Product Issues or Misrepresentation

If a buyer receives an item that’s damaged, defective, or not as described, they may initiate a chargeback. Always use high-quality product photos and accurate descriptions to set the right expectations.

4. Unauthorized Card Use

Fraudulent transactions often trigger chargebacks. Protect your store by monitoring suspicious orders and securing customer data. Using tools like a VPN (Virtual Private Network) can help keep payment information safe.

By addressing these areas proactively, you can minimize disputes and protect your brand’s credibility.

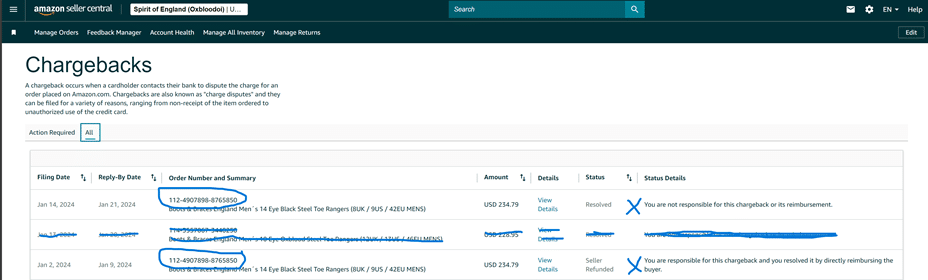

How to Know When a Chargeback Is Filed

Sellers can detect chargebacks through email notifications or Instant Payment Notifications (IPNs) from Amazon Pay.

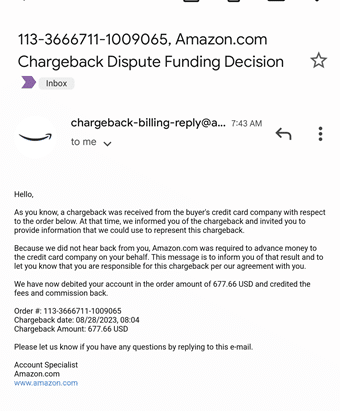

Email Notifications:

When a buyer disputes a transaction, Amazon Pay sends an email to your registered address. Make sure to check these notifications regularly.

Instant Payment Notifications (IPNs):

Setting up IPNs in your Seller Central allows you to receive real-time alerts about payment issues, including chargebacks. This enables quicker responses and better dispute management.

If you don’t use Amazon Pay, you can monitor chargeback claims directly in Seller Central under the Performance section.

Information Included in a Chargeback Notification

A chargeback notification from Amazon Pay contains key details that help you understand and respond to the dispute effectively, such as:

- Seller Order ID and Order Reference ID

- Transaction Date and Disputed Amount

- Card Type used (Visa, Mastercard, etc.)

- Dispute Type and Reason Code

These details guide your response and help you gather the correct evidence. The email also includes instructions and deadlines for submitting proof or documentation to challenge the chargeback.

What You Need to Dispute a Chargeback

To contest a chargeback successfully, you must provide clear and complete information that supports your case. This typically includes:

- Transaction Details: Purchase date and order summary.

- Product or Service Description: A full explanation of what was sold.

- Proof of Delivery: Shipment tracking or delivery confirmation.

You can also include additional supporting materials like:

- Order confirmations and refund records.

- System logs for digital items.

- Product photos and return policy documentation.

- Communication history with the buyer.

Comprehensive documentation increases your chances of winning the dispute and keeping the funds.

How to Resolve an Amazon Chargeback

When you receive a chargeback notice, you have two options:

1. Dispute the Chargeback

If you believe the claim is invalid, gather evidence and respond via the email notification from Amazon Pay. Provide proof that the transaction was legitimate, such as tracking data or customer communication.

2. Accept the Chargeback

If the dispute is valid or not worth contesting, you can accept it. The amount will then be deducted from your Amazon Pay account.

Always respond quickly—delays can lead to automatic chargeback acceptance.

Chargeback Fees

Amazon Pay charges a $20 Disputed Chargeback Fee per case if you decide to dispute it. However, this fee may be waived if the transaction qualifies for Amazon’s Payment Protection Policy or if Amazon Pay handles the dispute internally.

Even if your dispute is successful, the fee typically remains applicable, so consider whether contesting is worthwhile.

What Happens If You Don’t Respond on Time

Timing is crucial when managing chargebacks. You must respond within 11 calendar days of receiving the notification.

Failing to respond means Amazon Pay assumes you are not disputing the case and automatically deducts the transaction amount from your account. Quick action protects your funds and maintains your seller standing.

Amazon Seller Chargeback vs. Amazon Pay Chargeback

Amazon Seller Chargeback:

When transactions are processed through Amazon directly, Amazon acts as the merchant of record. You’ll receive a notification and can decide how to respond.

Amazon Pay Chargeback:

Here, the buyer’s bank contacts Amazon Pay directly, and Amazon serves as the intermediary. Depending on the type of dispute—unauthorized or service-related—different documentation and resolution methods apply.

Amazon Chargeback vs. A-to-z Guarantee Claim

The main difference lies in who handles the dispute:

- Amazon Chargeback: Managed externally by the buyer’s bank or card issuer. Amazon Pay has limited control over the outcome.

- A-to-z Guarantee Claim: Handled internally by Amazon as part of its buyer protection program. Amazon mediates between the buyer and seller to reach a resolution.

Tips to Prevent Amazon Chargebacks

- Understand Amazon’s Policies: Know your rights and obligations to stay compliant.

- Create Clear Return and Refund Policies: Make it easy for customers to resolve issues directly with you.

- Use Accurate Product Descriptions: Avoid misleading listings that can cause disputes.

- Keep Transaction Records: Always document orders, shipping, and communication.

- Invest in Customer Support: Quick, professional communication can resolve complaints before they escalate.

Final Thoughts

Chargebacks are an unavoidable part of selling online, but with preparation and awareness, you can manage them effectively. By keeping thorough records, communicating clearly with customers, and staying proactive, you’ll protect your business from unnecessary losses and maintain your Amazon seller reputation.