Understanding Amazon Business Invoices System

Invoices can be a powerful tool for attracting more business-to-business (B2B) customers. Compared to other forms of payment, invoices offer distinct advantages for both the buyer and the seller, which is why many businesses prefer using them. But how exactly do Amazon business invoices function, and what benefits do they offer your business? Let’s take a closer look.

What is an Invoiced Order?

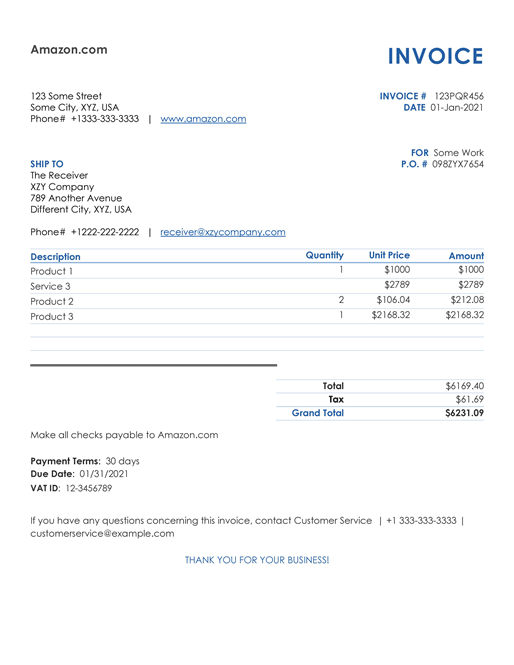

An invoiced order is a type of transaction where the buyer receives a formal invoice listing the items they’ve purchased. This document outlines all the details of the transaction and gives the buyer the option to pay later based on agreed payment terms. For instance, under “net 30” terms, payment is due 30 days after the purchase date.

Why Some B2B Buyers Prefer Paying via Invoice

Besides the convenience of deferring payment, invoices offer several benefits to B2B customers:

- Simplified purchasing: Invoices let buyers combine multiple purchases and pay for them all at once, saving time and resources.

- Better organization: Detailed invoices help businesses track expenses, maintain proper records, and streamline accounting tasks.

- Flexible payment options: Buyers can often pay using their preferred method, such as electronic bank transfers or checks.

How Invoices Function on Amazon

Eligible business buyers shopping on Amazon may qualify for the Pay by Invoice feature. This option allows them to pay via invoice for products listed by any seller. Pay by Invoice is part of Amazon Business, which equips sellers with tools and features to connect with B2B buyers effectively.

Benefits of Invoicing for Amazon Sellers

Pay by Invoice can bring multiple advantages to sellers on Amazon. Here’s why it might be worth enabling:

Increase Sales to Business Customers

By offering invoicing, you make your products more appealing to B2B buyers who prefer delayed payments. These customers often place larger orders and tend to return items less frequently—helping you sell more with fewer complications.

Reduce Time Spent on Admin Work

Managing invoices manually can be time-consuming. With Pay by Invoice, Amazon handles the back-office tasks, including credit checks, issuing invoices, sending reminders for overdue payments, billing, and tracking transactions.

Lower Your Risk of Nonpayment

Traditional invoicing carries the risk that a customer may not pay. Amazon reduces that risk by guaranteeing payment no later than seven days after the invoice due date, even if the buyer hasn’t paid yet.

Improve Cash Flow Management

Invoiced payments can delay cash flow, but Amazon offers an optional Get Paid Faster service. For a 1.5% fee on each invoiced amount, you can receive your payments more quickly, helping you manage your finances with less stress.

Using Seller Central to Track Invoiced Orders

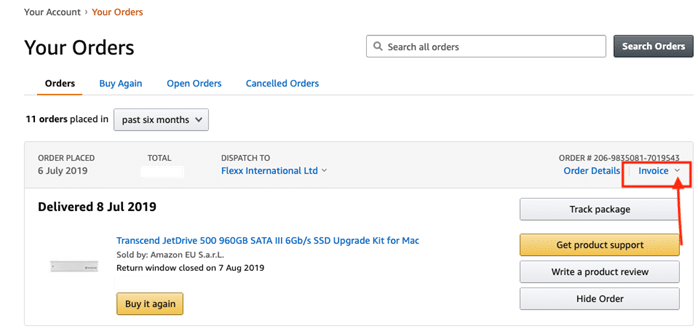

When you create a selling account, you get access to Seller Central—a central platform where you can monitor your sales, transactions, payments, and more. Here’s how you can view invoiced order details:

1. Statement View

This is the default view in the Payments Dashboard. After logging in, go to the “Payments” section to access it. You’ll see separate rows for standard and invoiced orders, along with a row for deferred transactions (which include pending payments). The dashboard also includes a graph with a breakdown of charges, refunds, and expenses, where you can toggle between standard and invoiced views.

2. Transaction View

To see details about specific transactions, click the amount shown in the “Total Balance” column under Deferred Transactions. This opens the Transaction View, where you can filter results by invoiced orders, status (like released or deferred), and custom date ranges. Clicking a transaction will give you more details, including the scheduled payment release date.

3. Reports Repository

For downloadable reports, go to the Reports Repository tab in the Payments Dashboard. Select “Invoiced Orders” as the account type, then choose a report type—Summary, Transaction, or Deferred Transaction. Pick a date range and click “Request Report” to download.

When Amazon Sellers Receive Payment for Invoiced Orders

Sellers receive payment either when the customer pays the invoice or—at the latest—seven days after the invoice due date. Typically, invoices follow net 30 terms, though sometimes the due date may extend to 45 days or more.

Until the funds are released, invoiced orders appear in your Seller Central account as deferred transactions. Transactions are deferred while waiting for payment or until delivery is confirmed. Once released, funds are added to your available balance and paid out in the next scheduled settlement. Amazon usually processes settlements every 14 days, though it may take a few business days for funds to reach your bank account.

You can track the invoiced payment process in three steps:

- Release Date: Check when funds are scheduled for release by selecting the transaction under Deferred Transactions and reviewing the “Payment Release Date” field.

- Disbursement Schedule: In the Statement View, view your next payout date and estimated amount.

- Transfer Status: Use the Disbursements tab to track when Amazon transfers funds and when they’ll arrive in your bank.

Invoicing Makes B2B Selling Easier on Amazon

While invoicing adds a layer of complexity, using Amazon’s tools can help simplify the process. If delayed payments might impact your operations or cash flow, invoicing might not be suitable. But without it, you may lose valuable B2B sales. With Amazon’s guaranteed payments and automated invoicing, selling to businesses becomes much easier and less risky.