Amazon Currency Converter: Seller’s Global Guide

The Amazon Currency Converter for Sellers (ACCS) is an integrated service that simplifies international payments for global sellers. It automatically converts sales revenue from various marketplaces into the seller’s preferred payout currency.

This eliminates the need for maintaining multiple bank accounts in different countries or manually calculating fluctuating exchange rates. Once all bank information and terms are verified, payments are transferred directly to the seller’s chosen bank account in their local currency.

Payments are sent regularly without disruptions caused by international transfer procedures. However, if a seller updates their bank information, payments may be delayed for up to 14 days as part of Amazon’s security process.

How Does Amazon Currency Converter for Sellers Work?

Amazon’s Currency Converter simplifies cross-border selling by handling all currency conversion automatically.

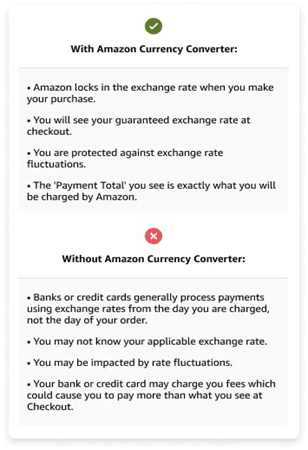

When a customer purchases from a different Amazon marketplace, the order is displayed in the buyer’s local currency. The ACCS then converts that amount into the seller’s payout currency using competitive exchange rates determined by Amazon.

Sellers can select their preferred payout currency from Amazon’s list of eligible currencies, ensuring they receive payments in the most convenient form for their business.

Amazon charges a small conversion fee on each order requiring currency conversion. This fee covers the cost of the service and is usually a percentage of the total transaction.

All invoices and financial reports provided to sellers include both the marketplace’s original currency and the converted payout amount. This transparency helps sellers reconcile their records and clearly track the impact of currency conversion on their sales.

Understanding Amazon Currency Converter Fees

While Amazon does not charge hidden fees for using the converter, it does apply a volume-based fee (VBF) that depends on the seller’s total annual sales volume—known as Total Processed Volume (TPV).

Here’s how Amazon’s currency converter fees are structured:

- 0.75% fee for revenue ≥ $10 million

- 1.00% fee for revenue ≥ $1 million

- 1.25% fee for revenue ≥ $500,000

- 1.50% fee for revenue ≥ $100,000

In short, higher sales volumes lead to lower conversion rates. Although the fees are transparent and relatively small, they can accumulate over time—especially for sellers handling large sums monthly. Therefore, understanding these costs is essential when planning global expansion.

How to Activate Amazon Currency Converter for Sellers

Activating the ACCS is a simple process. Follow these steps to get started:

- Log in to your Amazon Seller Central account.

- Navigate to the Payments section in the left-hand menu.

- Go to Payout Settings and find the Currency Converter option.

- Enroll in the Amazon Currency Converter for Sellers (ACCS) program.

Once activated, your earnings will automatically be converted and transferred to your local bank account in your chosen currency.

Pros and Cons of Using Amazon Currency Converter

Pros:

- Built directly into Seller Central—no need for external payment services.

- Simplified payouts in your local currency without manual calculations.

- Transparent fees with no hidden charges.

- Automated conversions reduce the risk of human error.

- Seamless integration enhances convenience for international sellers.

Cons:

- Currency rate fluctuations may still impact profits over time.

- Refunds processed under changing exchange rates may lead to minor losses.

- Limited control over exchange rate timing.

- Sellers new to international selling might find the system slightly complex at first.

Supported Countries and Currencies

Amazon Currency Converter for Sellers is available in 19 Amazon marketplaces and supports payouts in 44 different currencies. Only sellers with bank accounts in eligible countries can use this service.

Funds are transferred to the seller’s local account, and all sales reports reflect the currency of the marketplace where the transaction occurred. For instance, products sold on Amazon.com are documented in USD.

Documentation Requirements

Amazon enforces strict documentation and compliance requirements. Sellers should ensure they meet both Amazon’s and their local country’s financial and taxation rules.

Depending on your registration country, you may need to provide specific banking or identification documents. It’s advisable to consult a professional accountant or financial advisor to ensure compliance with local tax regulations.

If you operate multiple bank accounts across different regions, ensure that only your local account is linked to ACCS to avoid complications.

Refunds with Amazon Currency Converter

The currency of the marketplace where the sale occurred handles refunds processed under ACCS. For example, if you sell on Amazon.com, you issue refunds in USD.

Importantly, Amazon locks the exchange rate at the time of purchase, ensuring that it calculates refunds using the same rate. This protects sellers from potential losses due to exchange rate fluctuations.

Is Amazon Currency Converter Worth It?

In most cases, the Amazon Currency Converter for Sellers is a worthwhile option. It offers predictable rates, transparent fees, and automated reconciliation—helping sellers manage global payments without added stress.

While there are conversion fees involved, the simplicity, speed, and reliability of the service. Make it a strong choice for sellers expanding across multiple Amazon marketplaces.

Final Thoughts

The Amazon Currency Converter for Sellers (ACCS) takes the complexity out of managing global payments. By automating conversions and ensuring transparent rates, sellers can focus on business growth rather than dealing with financial technicalities.

Even though the volume-based fees may seem minor, evaluating your overall sales and profit structure can help determine whether ACCS is the best option for your business.

Using Amazon’s built-in currency converter ensures faster payouts, accurate reporting, and better financial control—making it a practical tool for global sellers.