Amazon Frequently Bought Together Strategy Guide for Sellers

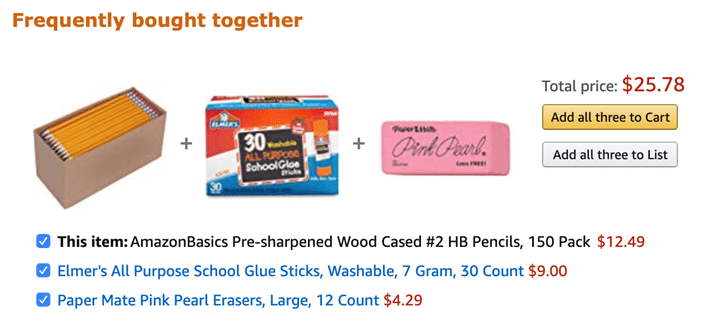

If you’ve ever sold products on Amazon, you’ve definitely noticed the small but powerful box beneath many listings labeled “Frequently Bought Together.” It usually shows two or three related products grouped together with a single “Add All to Cart” button, making the buying process frictionless for shoppers.

For sellers, this feature is often overlooked, despite being one of Amazon’s most valuable opportunities to increase average order value and protect listing visibility. The reality, however, is that Amazon didn’t design this recommendation engine to help sellers grow. It was built to increase cart size and keep customers within the Amazon ecosystem.

At its core, the Frequently Bought Together system is powered by a complementor strategy. Amazon uses one product to naturally drive demand for another, creating logical purchase combinations that feel effortless to the buyer.

This means if you’re not actively influencing which products are associated with your ASINs, Amazon will make that decision for you. And more often than not, your product may get paired with a competitor’s listing—or worse, an Amazon-owned private label.

Think of the FBT box as Amazon’s way of revealing what it believes your product pairs best with. These recommendations aren’t random. They’re built on years of purchase data, browsing behavior, and category-level trends.

While many sellers simply hope their products show up in these bundles, top-performing brands take a different approach. They intentionally shape buying behavior to force favorable FBT pairings that drive repeat sales and long-term visibility.

In a highly competitive marketplace like the U.S., where organic reach continues to shrink, leveraging Amazon Frequently Bought Together is no longer optional. When done right, it can be the difference between stagnant listings and consistent, compounding growth.

This guide breaks down how Amazon’s Frequently Bought Together works—and how sellers can turn it into a predictable sales engine.

How Amazon Frequently Bought Together Really Works

Many sellers assume the FBT box is just another version of “Customers Also Bought.” In reality, it operates on a much deeper and more sophisticated data model.

Amazon constantly analyzes how customers shop, what they view together, and which product combinations increase conversion rates. Understanding these mechanics gives sellers an advantage most competitors never tap into.

Below are the four core signals that power Amazon’s Frequently Bought Together system.

The Four Core Foundations of Frequently Bought Together

1. Purchase History

At its foundation, FBT is driven by completed transactions. When enough customers consistently buy two products in the same order, Amazon locks that combination into the Frequently Bought Together module.

This means sales velocity is not just about selling more units. It’s about being purchased alongside other complementary items. Products that naturally solve adjacent problems tend to form stronger associations.

For example, an ergonomic laptop stand isn’t just a standalone purchase. It logically pairs with external keyboards, mice, or laptops themselves. When a product fits seamlessly into an existing buying journey, Amazon’s system rewards that alignment.

2. Clickstream Behavior

Amazon doesn’t wait for checkouts to start connecting dots. It closely tracks how shoppers browse.

If users frequently view your product shortly after viewing another related ASIN, Amazon may begin testing that pairing in the FBT box. If those test pairings convert, the association becomes permanent.

For instance, if shoppers repeatedly click on a wireless mouse immediately after browsing a specific laptop stand, Amazon may start displaying them together as a recommended bundle.

3. Category Affinity

Certain categories naturally lend themselves to bundling. Electronics accessories, kitchen tools, supplements, and fitness gear are all strong examples.

Amazon already understands which categories pair well together, and sellers who align their product development and catalog strategy with these patterns gain a major advantage.

If you sell a French press, adding complementary products like a coffee grinder or reusable filters increases the likelihood that your own ASINs appear together in FBT placements.

4. Pricing Elasticity

Amazon favors add-ons that don’t create hesitation. When two products are priced within a comfortable psychological range, buyers are far more likely to click “Add All to Cart.”

Rather than discounting your main product, a smarter approach is offering a lower-cost complementary SKU. This keeps margins protected while increasing attach rates that strengthen FBT associations.

Frequently Bought Together vs Other Amazon Recommendations

It’s important not to confuse FBT with other Amazon recommendation tools. Each serves a different purpose.

Frequently Bought Together focuses on historical purchase behavior, while “Customers Also Bought” reflects general browsing trends. Sponsored placements, on the other hand, are paid and temporary.

FBT stands out because it compounds over time, delivering long-term organic visibility once established.

Why Amazon’s Data Advantage Matters for FBT

Amazon doesn’t surface FBT placements randomly. The system evaluates fulfillment reliability, pricing stability, and overall customer experience.

Products with consistent inventory, strong delivery performance, and lower return rates are more likely to win and keep these placements. Amazon prioritizes lifetime customer value, not one-time conversions.

For sellers in replenishable or consumable categories, this creates a powerful opportunity. Pairings that encourage repeat purchasing are far more likely to stick in the algorithm.

Why U.S. Sellers Must Leverage Frequently Bought Together

The U.S. Amazon marketplace has matured. Organic visibility continues to decline as competition grows and advertising costs rise.

Frequently Bought Together is one of the few remaining levers that still offers scalable, organic exposure. When your product appears alongside a bestseller, you benefit from its traffic and momentum without paying for every click.

Instead of competing aggressively in PPC auctions, FBT allows sellers to embed themselves directly into high-intent buying moments.

Why Cross-Selling Is No Longer Optional

U.S. shoppers are overwhelmed with choices. The products that win are those presented as the most logical add-on.

Sellers who master bundles, complementary SKUs, and engineered pairings will outperform competitors who rely solely on ads and keyword rankings.

U.S. Sellers vs Global Competition

International sellers often compete on price, operating on thin margins. While this can generate short-term wins, it rarely creates strong buying behavior patterns.

U.S. sellers, however, tend to understand local preferences better. They know which product combinations feel natural to American buyers and which price points convert without hesitation. Because Frequently Bought Together is driven by real buying behavior, this cultural understanding gives domestic sellers a long-term advantage.

Four Proven Strategies to Influence Frequently Bought Together

Strategy 1: Intelligent Product Pairing

Start by analyzing natural complementarities within your catalog. Products that solve adjacent problems tend to pair best.

Running product-targeted ads on related ASINs and optimizing listings to highlight compatibility signals Amazon that these items belong together.

Strategy 2: Inventory and Pricing Consistency

FBT placements collapse the moment one product goes out of stock. Consistent inventory across complementary SKUs is essential.

Strategic couponing on secondary items can push pairings into the conversion threshold Amazon looks for.

Strategy 3: Fulfillment Alignment

Delivery speed matters more than many sellers realize. Pairings with mismatched shipping times often fail.

Using FBA across all complementary products helps synchronize delivery windows, increasing the likelihood that Amazon keeps your products bundled.

Strategy 4: Category-Specific Optimization

Some categories are naturally bundle-heavy, such as kitchenware, supplements, and electronics.

If your niche is slower-moving, you’ll need to lean more heavily on promotions and targeted advertising to train the algorithm.

Using Ads and Attribution to Train FBT

You don’t have to wait for Amazon to make the first move. Product-targeting ads allow you to insert your ASIN into competitor traffic flows that are already converting.

Each successful cross-sale teaches Amazon that your product belongs in that buying sequence.

External traffic plays a role as well. When shoppers land on Amazon from social or search campaigns and purchase multiple SKUs together, Amazon logs that behavior and strengthens the association.

Over time, these paid efforts turn into organic FBT placements that continue producing sales long after ad spend stops.

Advanced Growth Tactics for Experienced Sellers

Leveraging Competitor Pairings

Study which ASINs dominate FBT placements in your niche. Then position your products as alternatives and use advertising to tap into that established buying behavior.

Turning Initial Momentum Into Long-Term Visibility

FBT is a feedback loop. Once established, it sustains itself. Sellers who treat the first 90 days as a foundation rather than a finish line build durable visibility that competitors struggle to disrupt.

Final Thoughts

Amazon Frequently Bought Together is not a passive feature—it’s a strategic growth mechanism.

Sellers who understand how it works and intentionally shape customer behavior can generate ongoing sales without escalating ad costs.

Audit your catalog, identify natural pairings, and start influencing the algorithm. Because if you don’t claim that space, a competitor will—and once they do, displacing them becomes extremely difficult.

The real question isn’t whether Frequently Bought Together matters. It’s whether you can afford to ignore it.