Amazon Insurance Accelerator: Complete Seller Guide

As an Amazon seller, managing risk is a key part of building a successful business. Selling on Amazon comes with challenges, and having the right insurance coverage ensures protection against unexpected financial losses.

To make this process easier, Amazon introduced the Amazon Insurance Accelerator. This program helps sellers quickly and efficiently obtain product liability insurance from trusted providers. In this article, we’ll explain what the program is, how it works, and why it’s important for your Amazon business.

What Is Amazon Insurance Accelerator?

The Amazon Insurance Accelerator connects Amazon sellers with a network of approved insurance providers, offering liability coverage at competitive rates. Its purpose is to simplify the process of purchasing product liability insurance, making it faster and more accessible.

This program allows U.S.-based sellers to receive quotes and purchase policies designed to meet their specific business needs. Since all providers are pre-vetted by Amazon, sellers don’t need to spend time researching insurers or worrying about hidden terms.

Note: According to the Amazon Services Business Solutions Agreement, if your sales exceed $10,000 in a month—or if Amazon specifically requests it—you must obtain commercial liability insurance within 30 days.

Pros and Cons of Amazon Insurance Accelerator

Pros

Amazon’s claims coverage

Through the program, Amazon covers valid claims up to $1,000, giving sellers added security and peace of mind.

Pre-vetted providers

Instead of researching insurers individually, sellers get access to a pre-approved list of reliable providers, making it easy to compare quotes and policies.

Coverage beyond Amazon

Some policies purchased through the Insurance Accelerator extend to products sold outside Amazon, giving sellers broader protection across multiple sales channels.

Cons

Limited provider selection

Currently, the Insurance Accelerator has a relatively small pool of providers, which may reduce flexibility for sellers looking for specific coverage options.

Not globally available

The program is not yet offered worldwide. Sellers outside supported regions cannot take advantage of its benefits.

No fixed rates

Insurance costs are not standardized, meaning sellers must request quotes to determine pricing. This can make budgeting more challenging

How Does Amazon Insurance Accelerator Work?

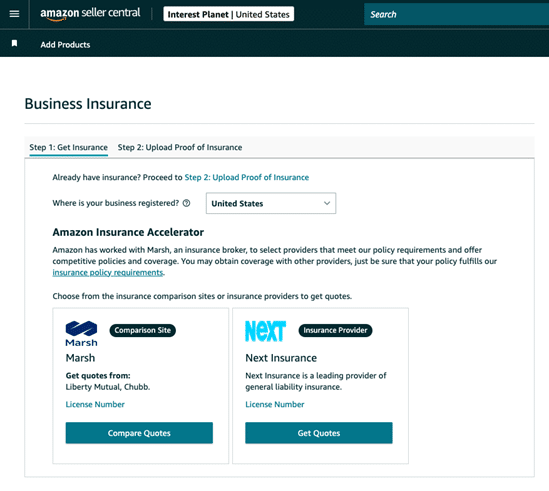

Once a seller’s monthly sales exceed $10,000, Amazon requires them to hold product liability insurance. Sellers can access the Insurance Accelerator via Seller Central under the Business Insurance section.

Here, they can review quotes and policies from different providers and choose the best fit. If a product causes injury, illness, or property damage, Amazon will cover damages up to $1,000. Claims above that amount are passed on to the seller’s insurer for settlement.

How to Get Insurance via Amazon Insurance Accelerator

Step 1. Access Seller Central

Log in to Seller Central, go to Settings > Account Info > Business Insurance and click Get Insurance.

Step 2. Compare quotes and policies

Browse and compare policies offered by different providers. Evaluate pricing, coverage, and terms before selecting the one that best suits your business.

Step 3. Upload proof of insurance

Once approved, upload your Certificate of Insurance in the Proof of Insurance tab. If you purchased insurance from an Accelerator provider, check the corresponding box before submitting.

How Much Does Amazon Insurance Cost?

The cost of product liability insurance on Amazon depends on your estimated annual revenue. On average, coverage costs between 0.25% and 1% of revenue, translating to roughly $500 to $2,000 per year for most sellers.

List of Insurance Accelerator Providers

Amazon works with Marsh, a leading insurance broker, to connect sellers with trusted insurers. Current participants include:

- Chubb

- Harborway Insurance (Spinnaker Insurance Company)

- Hiscox

- Liberty Mutual Insurance

- Markel

- Travelers

- Bold Penguin

- Simply Business, Inc.

- Next Insurance

Final Thoughts

The Amazon Insurance Accelerator provides sellers with a straightforward way to secure product liability insurance while staying compliant with Amazon’s requirements. By offering vetted providers and a simple comparison process, it saves time and ensures sellers can find the right coverage for their needs.

Protecting your business with proper insurance is essential when selling on Amazon. With the Insurance Accelerator, sellers can safeguard against unexpected risks and focus on growing their business with confidence.