How Amazon Pay Helps Reduce Cart Abandonment Rates?

Amazon Pay is a digital payment gateway that allows shoppers to complete transactions on external websites using the payment and shipping details already saved in their Amazon accounts.

This service simplifies transactions by eliminating the need to manually input personal and payment information during checkout. It is considered one of the most reliable payment systems for providing fast, hassle-free, and secure transactions for both sellers and buyers.

The platform has achieved widespread adoption globally, especially in the United States. Statistics show that the U.S. accounts for 49.01% of Amazon Pay’s total sales, generating around $27.35 billion.

Following the U.S., Germany comes in second with $11.88 billion in sales, with Japan, Italy, and the United Kingdom also representing significant market shares.

As more businesses integrate Amazon Pay, it continues to establish itself as a trusted payment solution that boosts online sales.

How Does Amazon Pay Work?

For shoppers, using Amazon Pay is a simple process:

- Select Amazon Pay: When checking out on a partner website, customers choose Amazon Pay as their preferred payment option.

- Log In: They log in with their Amazon credentials — no need to create a new account.

- Complete Purchase: The buyer confirms their payment and shipping details, then finalizes the order.

Types of Transactions

The setup process for online sellers may differ based on the e-commerce platform they use, but integrating this payment solution is generally straightforward.

Amazon Pay supports several transaction types to suit different business models. These include:

- Immediate Charges: Customers are charged as soon as their order is confirmed — ideal for fast-shipping e-commerce businesses.

- Deferred Payments: Payment is authorized at checkout but captured at a specific milestone, perfect for pre-orders and in-store pickup models.

- Installment Payments: The total cost is split into smaller payments — useful for custom orders or split shipments.

- Recurring Payments: Enables regular billing, whether fixed (like monthly subscriptions) or variable. Ideal for memberships or pay-as-you-go services.

- One-Time Purchase with Subscription: Allows a single product purchase alongside a new subscription registration.

- Refunds: Merchants can issue full or partial refunds for previously completed transactions, accommodating returns, partial fulfillments, or cancellations.

Benefits of Amazon Pay

For customers, Amazon Pay delivers several advantages:

- Trusted Security: Built on Amazon’s security infrastructure, it helps lower the risk of fraud.

- Convenience: No need for multiple account registrations or repeated entry of payment details.

- Purchase Protection: Qualifying purchases may be covered by Amazon’s A-to-z Guarantee.

- Familiar Checkout Process: Uses the same checkout experience customers know from Amazon.com.

For online businesses, here’s how Amazon Pay can drive growth:

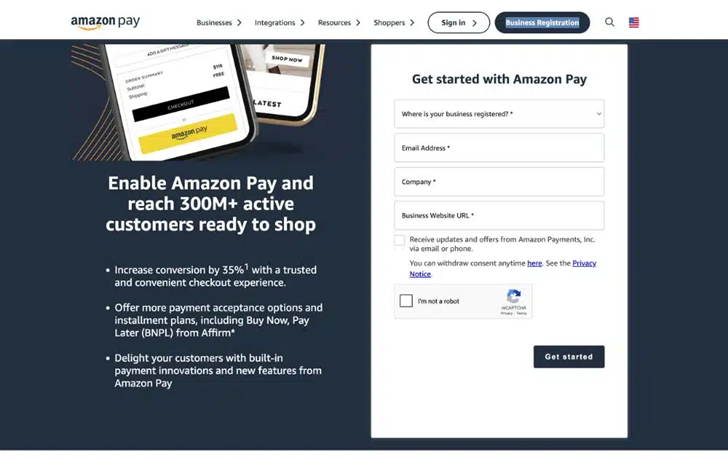

Improved Conversion Rates and Lower Cart Abandonment

Data indicates that 22% of shoppers leave their cart if the checkout process is slow or confusing. With Amazon Pay, customers can quickly finalize purchases using their saved information, minimizing friction and increasing conversion rates.

Boosted Credibility Through Amazon’s Brand Trust

A Baymard study found that one in four shoppers abandon transactions due to mistrust in a site’s ability to handle credit card information securely. By integrating Amazon Pay, merchants leverage Amazon’s trusted name, improving customer confidence and overall credibility.

Secure Transactions and Fraud Protection

Amazon Pay offers strong security features, including fraud detection, chargeback management, and risk assessment processes — all powered by Amazon’s proven security technology.

Key security benefits include:

- Sophisticated fraud detection tools

- Chargeback controls

- Comprehensive risk management

Mobile-Optimized Payment Experience

As mobile commerce (m-commerce) grows, making up 38% of total U.S. digital spending, having a mobile-friendly checkout is essential. Amazon Pay ensures smooth, fast mobile transactions, which improves customer satisfaction and reduces cart abandonment.

Seamless Integration with Leading E-Commerce Platforms

Amazon is compatible with popular platforms like:

- WooCommerce

- Shopify

- Magento

- BigCommerce

These integrations allow merchants to activate Amazon Pay with minimal technical effort.

Faster Payouts and Consistent Cash Flow

Amazon Pay automates payment disbursements, ensuring that sellers receive their funds on time. With scheduled payouts, merchants can maintain healthy cash flow and reduce delays in payment processing.

How to Set Up Amazon Pay for Your Business

Confirm Eligibility

Before registering, verify that your business meets Amazon Pay’s eligibility criteria, which may include location, business category, and compliance with Amazon’s policies.

Register for an Amazon Pay Merchant Account

Visit the Amazon Pay website and select “Sign Up.” You can use an existing Amazon Seller Central account or create a new one. Provide required business information, such as tax details, bank account information, and verification documents.

Set Up Your Seller Wallet

Use the Seller Wallet to manage transactions, process refunds, and receive payouts through Amazon Pay. Link your business bank account to enable automated disbursements according to Amazon’s schedule.

Integrate Amazon on Your Website

If you’re using platforms like Shopify, WooCommerce, Magento, or BigCommerce, simply install the Amazon Pay plugin. Test the integration with a trial purchase to ensure everything functions smoothly.

Begin Accepting Payments

After completing integration and verification, activate Amazon Pay on your checkout page. You can increase conversions and customer satisfaction by allowing your customers to use their Amazon credentials for safe, easy transactions.

Amazon Pay vs. Other Payment Methods

Let’s compare Amazon Pay with other widely-used online payment services:

| Functionality | Amazon Pay | PayPal | Google Pay | Credit Cards |

| User Base | Amazon customers, especially Prime users | Large international user base | Google account and Android device users | Broad consumer adoption |

| Integration | Integrates easily with WooCommerce, Shopify, Magento | Works with most e-commerce platforms | Compatible with many online services | Requires a payment processor |

| Security | Amazon’s encryption and fraud protection | Buyer Protection and encryption | Multi-layer tokenization | PCI DSS compliance |

| Fees | Varies by region, volume, and business model | Varies | Varies | Varies |

When choosing a payment solution, it’s important to evaluate transaction fees, target markets, and your business’s operating model to determine the best option.

Common Issues and Troubleshooting

Some merchants may encounter technical or transaction-related problems. Here’s how to address a few common issues:

Payment Button Not Displaying at Checkout

Possible Causes:

- Incorrect integration

- Service not activated in payment settings

Solutions:

- Verify that payment method is enabled in your platform’s settings

- Ensure your business account is fully verified

Customers Unable to Complete Transactions

Possible Causes:

- Mismatched billing and shipping addresses

- Service unavailable in the customer’s country

Solutions:

- Advise the customer to update their payment method

- Confirm that your store accepts payments from the customer’s region

Delayed Payments to Seller Wallet

Possible Causes:

- Incorrect banking details

- Standard payout schedule delays

Solutions:

- Check your wallet settings and banking details for accuracy

- Review Amazon’s payout schedule for expected processing times

Final Thoughts

The payment method has emerged as a valuable tool for online sellers — enhancing transaction security, increasing conversion rates, and providing reliable fraud protection. It delivers a seamless checkout experience for customers while supporting merchants in managing payments efficiently.

If you’re ready to optimize your e-commerce business, connect with SAECOM FBA Pro. Their team of e-commerce specialists can help maximize conversions, improve listings, and streamline your store’s operations for better performance and growth.