Selling on Amazon in 2025: LLC vs Sole Proprietorship

If you’re just starting to look into the world of ecommerce and considering selling products on Amazon, you might be asking yourself: “Is an LLC necessary to start selling on Amazon?”

The short answer is no — you don’t need an LLC to begin selling on Amazon. You can launch your business immediately using your personal name as a sole proprietor.

However, as your Amazon business grows, should you eventually consider forming an LLC? What makes an LLC different from a sole proprietorship? And what advantages come with having an LLC for your business?

What is a Sole Proprietorship?

A sole proprietorship is an informal business structure owned and operated by a single individual. You automatically become a sole proprietor the moment you start selling a product or service.

This is the easiest and quickest way to begin selling online. But it’s important to remember that there’s no legal distinction between you and your business under this structure. This means you’re personally responsible for any debts, financial obligations, or legal issues that your business may encounter.

What is an LLC?

An LLC, or Limited Liability Company, is a legal business structure in the United States designed to protect business owners from personal liability. Unlike a sole proprietorship, an LLC creates a legal separation between the business and its owners. This separation shields your personal assets — like your home and savings — from business-related debts and lawsuits.

LLCs can be formed by one or multiple owners, while a sole proprietorship always has just one.

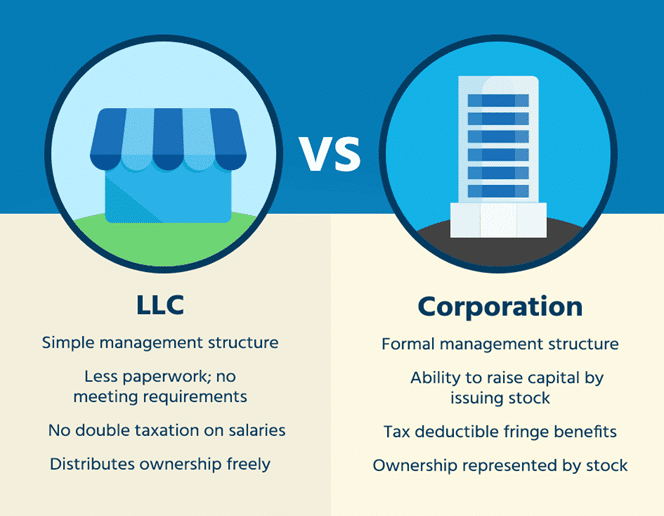

How is an LLC Different from a Sole Proprietorship?

The key distinction between an LLC and a sole proprietorship is the liability protection offered by an LLC. An LLC is a separate legal entity from its owners. This means the business can own assets, take on debts, file lawsuits, or be sued — all independently of its owners.

On the other hand, with a sole proprietorship, you and your business are legally considered the same. If your business faces financial trouble or legal claims, your personal assets could be at risk. While business insurance offers some protection, forming an LLC creates a clearer boundary between your personal finances and your business.

For tax purposes, a single-member LLC is typically taxed in the same way as a sole proprietorship, but with added protection benefits.

When Should You Consider Forming an LLC for Your Amazon Business?

It’s a good idea to set up an LLC when your business starts gaining momentum and you’re committed to growing it further. Establishing an LLC is one of the best steps you can take to safeguard your personal assets as your ecommerce venture expands. Consider forming an LLC if:

- You’re committed to building a long-term Amazon business

- Your monthly sales are steadily increasing

- You sell products with higher liability risks, such as supplements, health products, or sports gear

- You want to clearly separate your personal finances from your business

- You have one or more business partners

If any of these scenarios apply to you, it’s wise to look into forming an LLC soon. The process isn’t as complicated as it may seem and can offer lasting legal and financial protection.

Do You Need a Business License to Sell on Amazon?

In most cases, Amazon does not require a business license to create a seller account. However, your state or local government might require one, depending on where you operate and what you sell. This is why it’s always smart to check in with an accountant or legal expert when setting up your business.

If you plan to sell wholesale products on Amazon, you’ll likely need both a business license and a sales tax permit. Most wholesalers and manufacturers will ask for these documents before you can open an account with them.

For private label sellers or those doing retail arbitrage, a business license is usually not necessary.

What is a Sales Tax Permit and Do You Need One?

A sales tax permit — often called a resale certificate — allows you to buy inventory without paying sales tax and legally collect sales tax from your customers on behalf of your state. In most cases, if you’re selling goods on Amazon, your state will require you to obtain this permit.

For instance, if your business is registered in New Jersey and you sell to a customer within the state, you’ll be obligated to collect and remit sales tax quarterly to the New Jersey Division of Taxation.

Additionally, if you’re using Amazon FBA and your inventory is stored in fulfillment centers in different states, you may also need to handle sales tax obligations in those states.

As always, it’s best to speak with a tax professional to understand your business’s specific tax responsibilities.

How Do You Register a Business for Selling on Amazon?

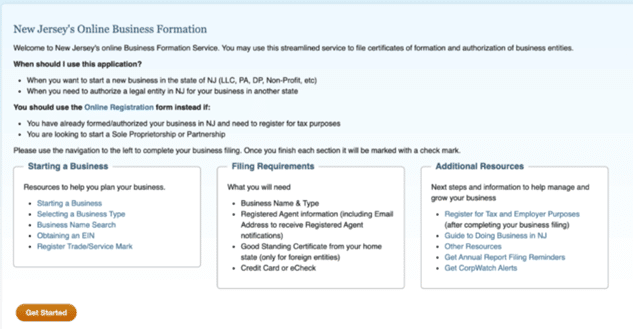

When you’re ready to establish your business as an LLC, you can start by visiting your state’s official business registration website. Each state has its own filing requirements and fees, which can vary widely.

You can also hire an accountant or use a service like LegalZoom to handle the paperwork for you, although this typically costs more.

Your state’s website should outline everything you need to know about forming a business. For example, if you’re in New Jersey, you’ll find step-by-step instructions on the state’s official business formation page.

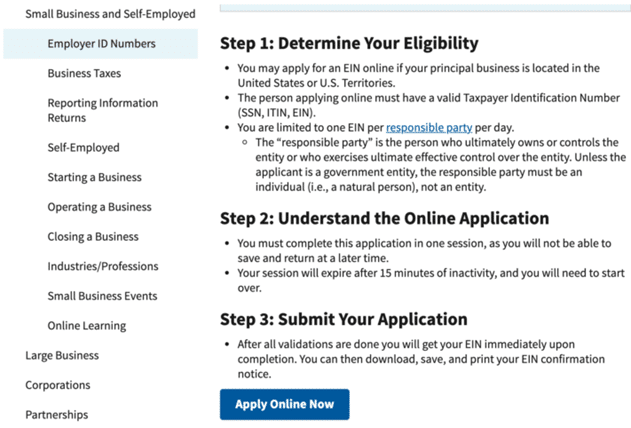

Do You Need an EIN?

Yes — when you form an LLC, you’ll need to get an EIN, or Employer Identification Number. This number acts like a Social Security number for your business and is how the IRS tracks your business’s taxes.

You can apply for an EIN for free on the official IRS website. Be cautious of third-party services that charge for this application, as the process is quick, simple, and free when done through the IRS directly.

Choose the Right Business Structure for You

Deciding between a sole proprietorship and an LLC can feel overwhelming at first, but once you take the time to research both options, it becomes much easier to understand. Learning about these business structures is essential before you start selling on Amazon.

In summary: If you’re just testing the waters of ecommerce, staying a sole proprietor is fine. But if you’re ready to scale your business and protect yourself legally, forming an LLC is the smarter long-term choice.

Do you currently have an LLC, or has running your business as a sole proprietor worked well for you? Share your experience in the comments! And if you have questions about business formation or selling on Amazon, feel free to ask — we’re happy to help.