Tips to Pass Amazon Invoice Check for Sellers

Selling on Amazon can be highly competitive—and wherever competition thrives, fraud often follows. To protect both sellers and customers, Amazon has tightened its quality control systems, with one major measure being Amazon Invoice Verification.

This verification process requires sellers to submit authentic invoices for the products they list. It’s Amazon’s way of ensuring that only legitimate, high-quality, and original goods are sold on its marketplace.

While some sellers find the process tedious, others appreciate its value in protecting brands and maintaining trust. Understanding how the invoice verification system works is key to passing it successfully.

What Is the Amazon Invoice Verification Test?

The Amazon Invoice Verification Test is designed to confirm that products sold on Amazon are genuine, safe, and sourced from credible suppliers. It’s part of Amazon’s broader effort to address customer complaints about product authenticity and quality.

This system allows Amazon to verify seller invoices directly with suppliers or manufacturers. The company may call or email them to confirm the documents’ validity. Even genuine invoices can be rejected if they fail to meet Amazon’s specific verification criteria.

To simplify your process, consider organizing all invoices digitally for easier management, review, and verification whenever needed.

Why Does Amazon Ask for Invoices?

Amazon usually requests invoices when there are concerns about a seller’s product quality or authenticity. Common reasons include:

- Customer complaints about defective or counterfeit products

- Concerns over items being sold as “new” when used

- Discrepancies between product listings and actual items delivered

- Safety-related issues

Sometimes, Amazon’s algorithm also flags certain listings preemptively for invoice verification, even before a complaint is made. While this ensures quality control, it can be challenging for dropshippers who often don’t have invoices until after a sale.

What If I Don’t Have Any Invoices to Provide?

Amazon sellers come from various backgrounds—dropshippers, private label owners, retail arbitrage (RA) sellers, or manufacturers. Each faces unique challenges when it comes to invoice verification.

Dropshipping

If you’re dropshipping, Amazon usually won’t suspend your account just because you lack invoices during registration. However, this model carries high risk. Since dropshippers only receive supplier documentation after fulfilling an order, verifying product quality beforehand is difficult.

Private Label Sellers

Private label sellers have it easier. Because they source directly from manufacturers, they can easily obtain official invoices. Maintaining close relationships with suppliers helps ensure smooth verification.

Retail Arbitrage Sellers

RA or OA sellers often rely on store receipts rather than supplier invoices. Unfortunately, retail receipts may not satisfy Amazon’s authenticity checks, which can put sellers at risk of infringement or counterfeit claims.

Manufacturers

If you manufacture your own products, you’ll need to separate your manufacturer entity from your seller entity. By doing so, you can issue proper invoices between both, ensuring Amazon accepts them as valid business documentation.

You can also source items from trusted suppliers and keep official invoices from them for verification purposes.

How to Ensure That Your Invoice Will Be Accepted

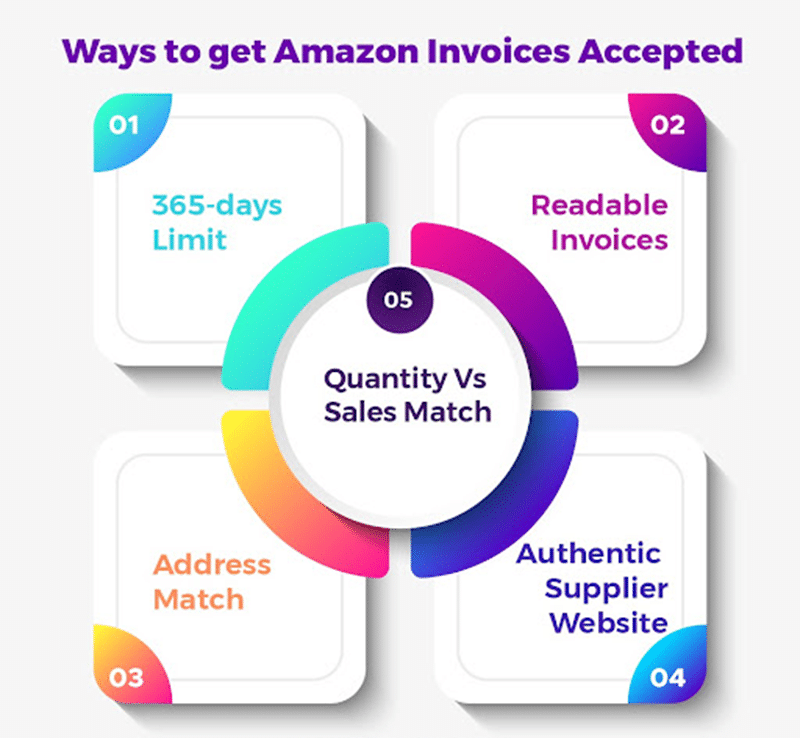

To avoid rejection, make sure your invoice meets Amazon’s standards. Here’s what you should keep in mind:

- Check the 365-Day Limit

Amazon only accepts invoices issued within the last 365 days. Anything older may be considered invalid. - Ensure Readability

Your invoice should be clear and legible. Smudged or blurry documents can delay approval or result in rejection. - Avoid Handwritten Invoices

Amazon does not accept handwritten invoices. Always request printed or digital versions from your supplier. - Supplier Website Verification

Make sure your supplier has an active and professional website. This helps Amazon verify authenticity quickly and boosts your invoice’s credibility. - Address Consistency

The address on your invoice must match the address listed in your Seller Central account and on your supplier’s website. Any mismatch can lead to rejection. - Quantity vs. Sales Alignment

Ensure your invoice quantities match your actual sales numbers. If sales exceed the number of products listed on your invoice, Amazon may flag it as invalid.

Following these steps significantly increases your chances of passing the verification test without issues.

What Happens If You Have No Invoice?

If you’re unable to produce invoices when requested:

- Amazon might limit access to certain ASINs or ask for additional proof of authenticity.

- Drop-shippers may need to contact Amazon Support to explain their situation and request flexibility in documentation timing.

- Private label sellers can generally provide documentation easily, but must still comply with invoice verification when required.

Being proactive about obtaining and organizing invoices can save time and prevent account restrictions.

What Happens If You Fake an Amazon Invoice?

Forging or altering invoices is a serious violation. Amazon’s trained compliance team can easily detect fake or edited documents.

Submitting falsified invoices may lead to:

- Immediate seller account suspension

- Permanent loss of selling privileges

- Legal consequences for fraud

If you’ve ever used a modified invoice, it’s best to remove it immediately and replace it with a legitimate one. Integrity and transparency are key to long-term success on Amazon.

How to Avoid Invoice Verification Requests

The best way to avoid invoice verification requests is to prevent the issues that cause them in the first place. While customer complaints can’t always be avoided, you can minimize risks by:

- Ensuring your listings accurately represent your products (photos, descriptions, and features)

- Using strong, protective packaging to prevent damage during transit—many “used sold as new” complaints come from poor packaging

- Responding quickly to customer queries and feedback to build trust and reduce complaints

Staying active and responsive helps you stay in Amazon’s good standing and reduces verification triggers.

Final Thoughts

Amazon’s invoice verification process exists to maintain marketplace integrity and protect buyers. Sellers who take it seriously can avoid account suspensions, negative feedback, and unnecessary delays.

Be proactive—collect, organize, and verify your supplier invoices before Amazon requests them. Think of it as business insurance: it’s better to have proper documentation and not need it, than to need it and not have it.

With careful preparation and ethical practices, you can pass Amazon’s invoice verification test confidently and keep your selling journey smooth and secure.